income tax rate indonesia

Income earned by an individual who is working in Indonesia is subject to personal. Indonesia Residents Income Tax Tables in 2022.

Personal Income Tax Pit In Indonesia Acclime Indonesia

This regime is optional for eligible taxpayers and only applicable for certain period of time depending on the type of taxpayer.

. Individual income tax rates. The changes include a new top individual income tax rate of 35 on. Try to calculate your personal tax for free now.

The following is Indonesias income tax rates compared to other countries. The Personal Income Tax Rate in Indonesia stands at 30 percent. Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent.

For resident taxpayer the top marginal income tax rate is 30 for income above IDR 500 million. In general a corporate income tax rate of 25 percent applies in Indonesia. This applicable tax rates are progressive based on annual income.

Corporate Income Tax Rate. Corporate income tax rate PPh badan. Companies listed on the Indonesia Stock Exchange.

There are exceptions although the standard corporate income tax in Indonesia is 25 percent. However certain tax objects or industries have special tax regimes. However there are several exemptions.

A flat CIT rate of 22 generally applies to net taxable income. If you obtain a lump sum of. Iv Article 23 income tax PPh 23 Certain types of.

Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax rate 22 standard ratevarious Residence. According to government regulation Peraturan Pemerintah 232018 a new tax rate is about to apply for the income. Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are.

Estimate your own income tax in Indonesia for the current year through our Personal Income Tax Calculator. Enter Your Salary and. New Reduced Income Tax Rate in Indonesia.

Follow these simple steps to calculate your salary after tax in Indonesia using the Indonesia Salary Calculator 2022 which is updated with the 202223 tax tables. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations. 07 Jan 22.

Income Tax Rates and Thresholds Annual. If you are previously a taxpayer resident and decide to retire in Indonesia your monthly retirement fund will be subjected to taxes similar to locals. Normal rate of taxation in Indonesia corporate income is 25.

From January 2022 new progressive income tax rates come into effect in Indonesia.

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Corporate Income Tax In Indonesia Acclime Indonesia

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Personal Income Tax Pit In Indonesia Acclime Indonesia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

New 2021 Irs Income Tax Brackets And Phaseouts

How To Calculate Income Tax In Excel

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Indonesia Income Tax Rates For 2022 Activpayroll

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

How To Calculate Foreigner S Income Tax In China China Admissions

Indonesia Income Tax Rates For 2022 Activpayroll

Tax Identification Numbers In Laos Compliance By June 2021

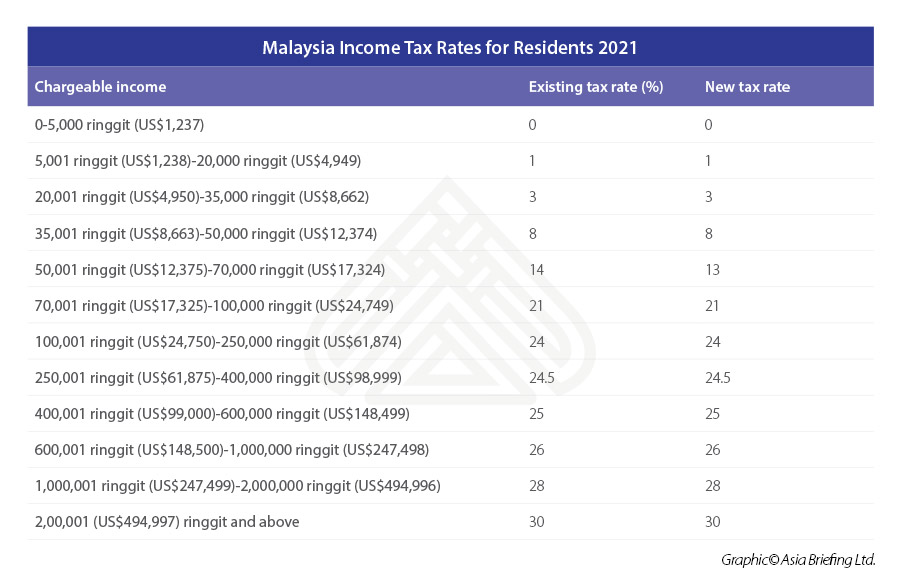

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical